Our survey showed that 25% of students have used payday-lending companies. With ever more of these companies – some specifically targeting students overtly or covertly on campus how can you make a more informed decision about short-term, high-interest loans? And why are more students turning to them?

Research by the NUS found that many vulnerable students access high-risk debt (including payday loans, cash-a-cheque and doorstep loans).

Why is this a problem?

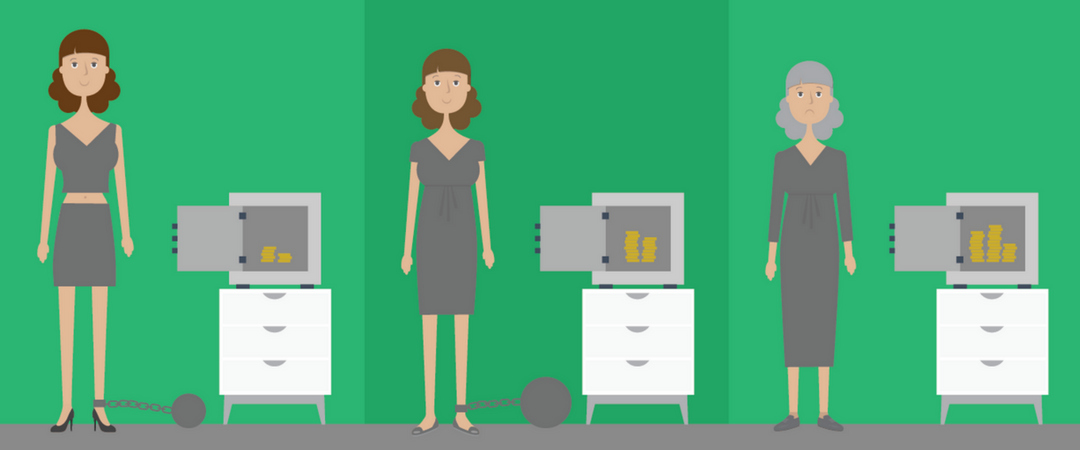

Stepchange have seen an 82% increase in the number of people asking for help specifically to tackle payday lenders. The National Union of Students (NUS) have launched a campaign to help students’ unions get payday loan advertising banned from college and universities. They found a ‘worrying’ number of students are applying for short-term loans, which typically charge around 1000% APR (Annual percentage rate) interest. This means that if you don’t pay the loan off on time, you could be many hundreds or thousands of pounds in debt in a very short amount of time.

For example if you took out a loan of £500 for 3 months, the length of a typical semester, then you would have to pay back around £800. Much more than you borrowed in the first place.

If you borrowed it for longer, say 6 months, you’d be paying back £2900. That’s an astonishing amount of interest, built up through a compounding interest effect.

So why are students using them?

The inevitability of debt

Worryingly many students look at payday lenders as simple “more debt” – figuring if you already owe so much then what’s a bit more.

Accommodation group Unite found that “Rather than a two-way split between those who see debt as a problem versus those who do not, a third approach is apparent in which some students are merely resigned to the inevitability of debt.”

It’s incredibly easy

Payday loan adverts are all over the internet, and many such sites use Search Engine Optimisation to make sure their websites appear near the top of search engine results.

When searching for student loan advice multiple results for websites turn up that claim to offer “quick approval” for loans, even if the applicant is unemployed. Many of these are payday brokers, who receive money for each referral they get. The websites, often based abroad, then pass on customer details to actual payday lenders. They often disappear quickly and are difficult to track and regulate.

There is a danger too that you will pay a fee even if you don’t use the service. Be careful.

Bridging the gap

According to our survey 51% of students run out of money before they run out of month meaning that for many students there is a very real gap between what it costs to be a student and what a student receives in support.

When students regularly worry about meeting basic living expenses like rent and utility bills they can look for perceived easy money. Quick and easy-access payday loans would seem to fit the bill.

But there is no such thing as easy money, money which comes quickly needs to be paid back quickly too…. with penalty.

If you do get in trouble with debt there are places to turn for independent and confidential advice. Citizen’s Advice can help, so too can the Debt Support Trust. And of course most universities provide money-advisory support staff and counseling services too.

And whatever you do don’t think you are alone with debt problems… get some help and get sorted.