Just when you thought 2021 couldn’t get crazier than 2020 – the cowboy traders of Reddit are bringing the action!

Pumped up on boredom, with spare cash and lock-down fever, a new gold rush is underway as traders send shares of videogame retailer GameStop flying, baffling the finance media and bringing financial pain to the short sellers*

The impact is now spreading to other stocks including the fashion retailer Express, the early 2000’ favourite business handset Blackberry and the 90’s favourite telco Nokia in what is becoming an epic battle between amateur traders, with free trading platforms, on one side and the finance establishment on the other.

Does this moment really matter?

In the old days of the market the huge firepower of institutional investors (think the investment banks) and established short-sellers (those mysterious hedge funds) would easily knock out movements created by retail investors (you and me).

Retail investors weren’t market makers – they had little power to create direction or momentum. Market manipulation, whether overt, covert, or just winks and nods over a whiskey was the purview of the big boys.

But welcome to the brave new world! An army of retail traders – spotting trading opportunities on Reddit, Youtube, Instagram, and TikTok – are now moving the needle and, much to the horror of the old guard, beating the big investment houses at their own game.

Markets, certainly in the short term, are much more about people, perception, and their emotions, and this new breed of traders aren’t concerned with “market fundamentals” or “intrinsic value”.

They want to make money, and they want to make “the house” suffer.

There are plenty of theories about why Gamestop is where the battle lines have been drawn – but one thing we know for certain is that the r/WallStreetBets people don’t like the short-sellers and want them to bleed.

A user on the reddit site published an open letter to CNBC, saying, among other things “Seriously. Motherf**k these people. I sincerely hope they suffer. We want to see the loss porn”

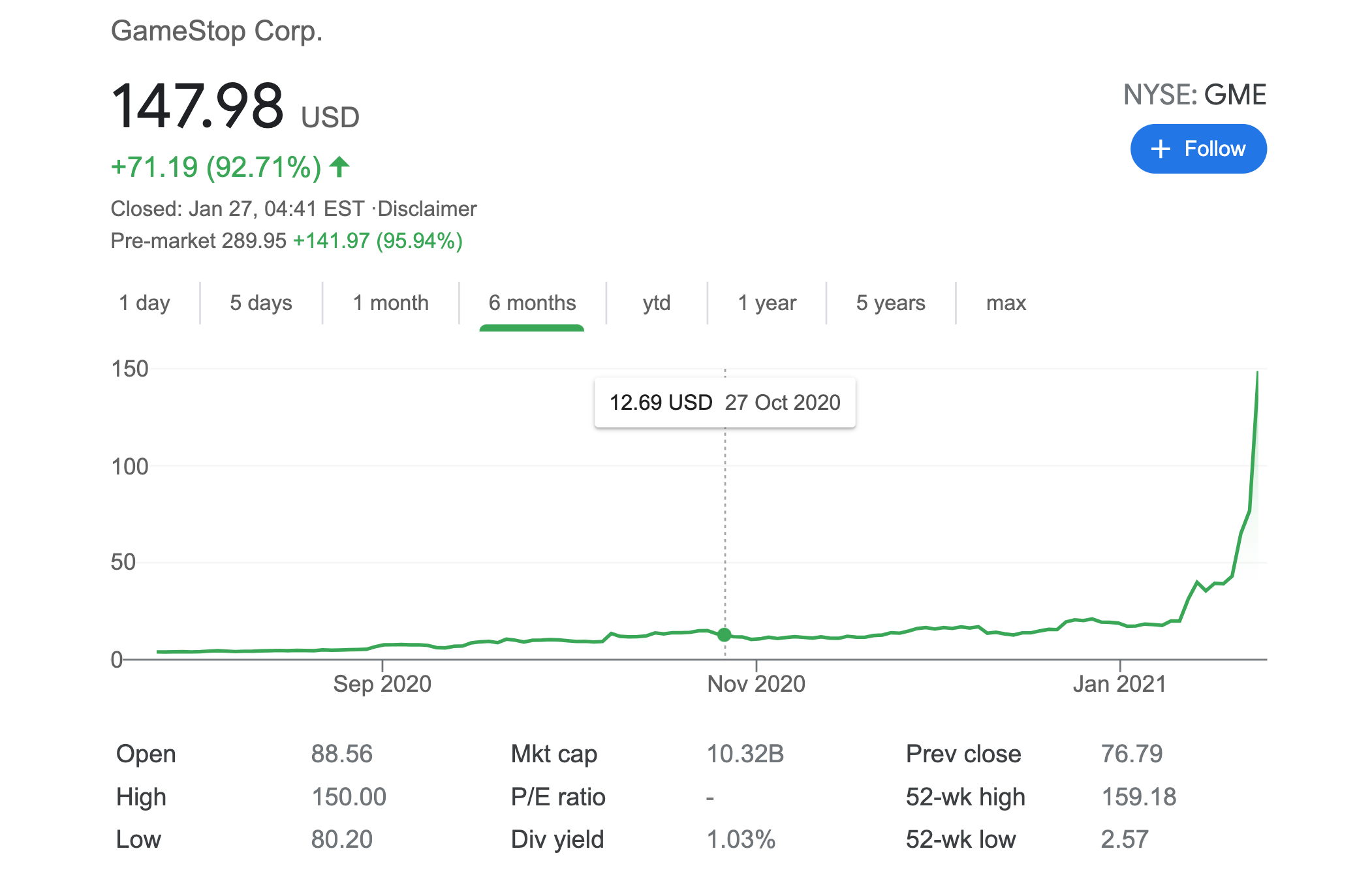

And that’s what they are indeed seeing…. Gamestop short-sellers have lost $5 billion (so far) this year. After pushing the stock up with colourful emoji laden threads Gamestop’s share price at close of trade on Tuesday (26th Jan) was $147.98 a 92.71% daily increase.

Why does it matter?

Enter the age of the finfluencer! As long as influencers keep retail traders buying, the price will continue to rise.

Until it doesn’t.

Gamification may be new but the market has always been a game, and while this tug of war between tradition and the future may make you think that “this time it’s different” the game hasn’t actually changed and retail investors, playing with their own money, have a lot to lose (unlike Hedge Funds who are actually investing other people’s – usually very rich other people – money).

This time isn’t different, a reckoning always comes – whether it’s a correction or a crash – because at the end of the day the fundamentals of a business matter.

So be careful. Very careful.

*Short-sellers (hedge funds and the like are betting on a stock dropping in price. On a technical level what they do is borrow shares, immediately sell them, in the hope of later buying them at a lower price and return them to the lender while pocketing the difference. It’s an extremely risky way of trading because if they are wrong, if the stock goes up instead of down there is (theoretically) no limit to the potential loss.

To watch how it all unfolded check out this video.

As we publish this, GameStop is up to $340/per share, up 134% in pre-trading, check out the Squawk Box take on the insanity of the moment.