We may be hearing less these days about payday loans, but after tonight’s BBC Panorama: Easy Money, Tough Debt? you will be hearing loads more about guarantor loans. The investigation has discovered that people are in debt to the tune of over £1 billion.

The kicker is that this is money they owe on behalf of other people because they signed up as a guarantor.

So what is a guarantor loan?

A guarantor loan is a loan where the borrower nominates someone else to make payments if they are unable to.

So Sam wants to borrow £1,000 to take a holiday but doesn’t pass the affordability check alone. Sam asks Alex to be a guarantor and the lender is now willing to lend £1,000 (at 49.5% APR). But Sam becomes unexpectedly unemployed and can’t afford to pay back the loan (plus interest) so now Alex owes the money. And the longer it’s owed the more the interests grows the bigger the debt hole Alex is in.

All because Sam wanted a holiday he couldn’t afford!

This is why being a guarantor is hardly ever a good idea. If you sign as a guarantor you are taking the responsibility to pay the loan back if the actual borrower can’t pay back their loan.

We can’t ban these products. The simple truth is that there are many people who rely on these types of products to get through the month. People who are unable to access reasonable credit will have to resort to whatever is available – whether payday loans, guarantor loans or even loan sharks.

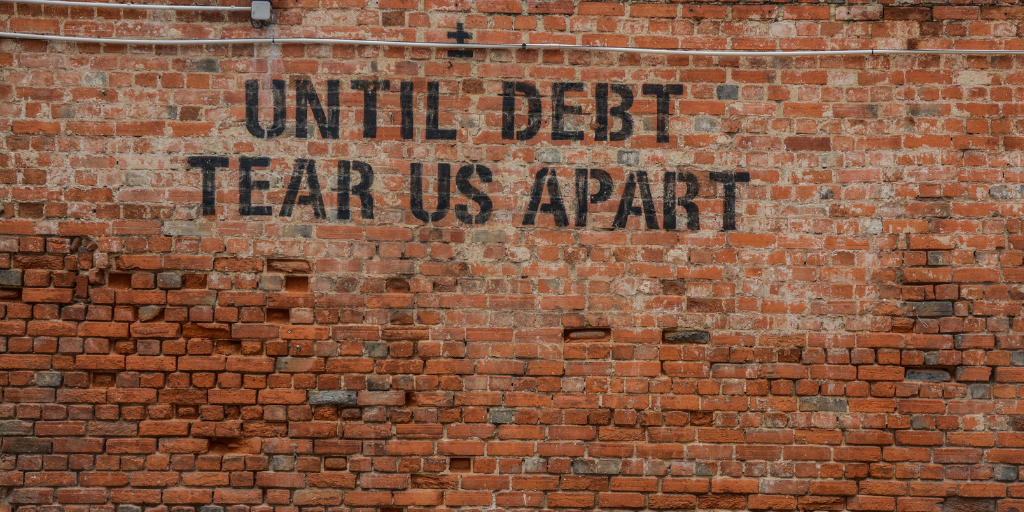

It’s expensive to be poor.

What we can do is educate people about the consequences and risks of using these products, so anyone is capable of making an informed decision about their finances.

It really is that simple.