Today’s FT declares that young people need to be saving 18% of their salaries into a pension. 18 PER CENT.

Holy crap, Batman. Where on earth are we supposed to find that kind of money? Between high rent, student loan repayments, food, transport and the myriad of other things we need to buy every day and week, how on earth are we going to be able to tick that box too?

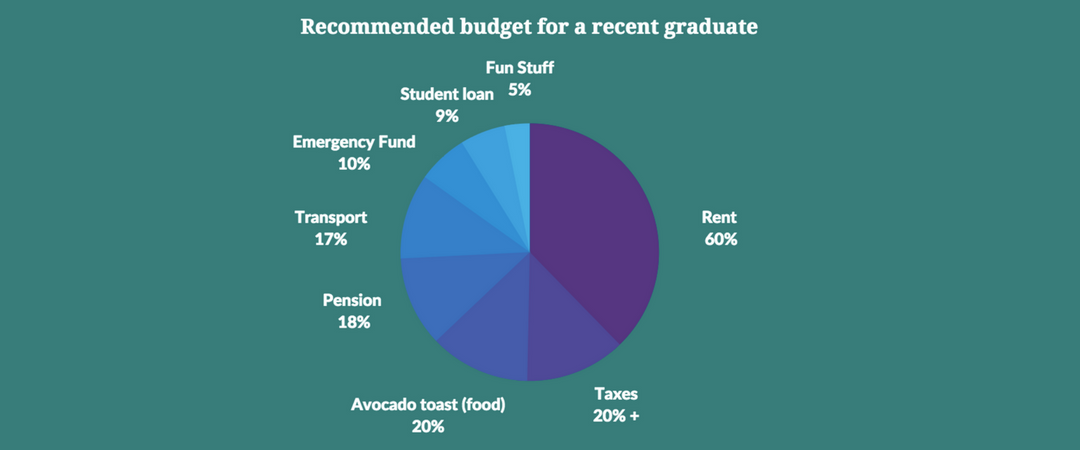

So we wanted to break it down a bit – cos part of the problem is that the whole pension and retirement gig is really overwhelming. So let’s focus on just the one thing: Budgets. After all budgeting is how we figure out where we are at.

You already know that budgets are two-sided. One the one hand we cut things to spend less money, on the other hand we try to make more money. Think of your money as a pie – you can reduce your slice or you can make a bigger pie!

Things to cut:

- Get frugal with your daily coffee (£1,500 per year), takeaways (£3,600) and booze (£2,600).

- Memberships and subscriptions: Uber, Spotify, gyms, magazines, TV packages – do you even know where your money is going?

- Get organised – are you booking trips home way ahead of schedule? Getting the best deal on your insurance and mobile contract can make a huge difference too.

- Get your debt sorted – if you have payday loans or any other high interest loans that is the first place to start. Interest is a killer so kill it first!

Now it’s not just about reducing the slice of pie. Cutting can only get you so far. And frankly cutting back and cutting down sucks. It’s also limited in its value because at some point you run out of things to cut. The least painful way to get your budget in order is to have more money, which of course means making more.

So let’s look at the other side of the equation. The greatest asset you have is you, and you can always make more money – you have infinite potential. There may be a floor, but there is no ceiling!

Things to add:

- Job – part time, casual or flexible, there have never been more ways to earn some cash on the side (e.g. food delivery, babysitting, flyering, dog walking, etc)

- Freelance – if you are any sort of creative there are loads of sites on which you can sell your services (e.g. design, web design, writing, singing, editing, voiceovers, etc)

- Sell your random stuff – not a long term solution but an easy way to make some quick cash (e.g. eBay, craigslist and gumtree are good places to start)

- Enterprise – you’ve probably got a business in you. 50% of people want to start a business, so what are you waiting for? You don’t need a lot of money and if the bedroom was good enough for Zuck it’s good enough for you

- Earn more where you are – what do you need to do to get a promotion? Get a bonus? Renegotiate your salary? If you don’t ask, you don’t get!

So give a bit of cutting and adding a go and see where it gets you – even if you don’t reach that 18% (18 PER CENT?!) pension savings target, starting to save as early as possible is the key secret.