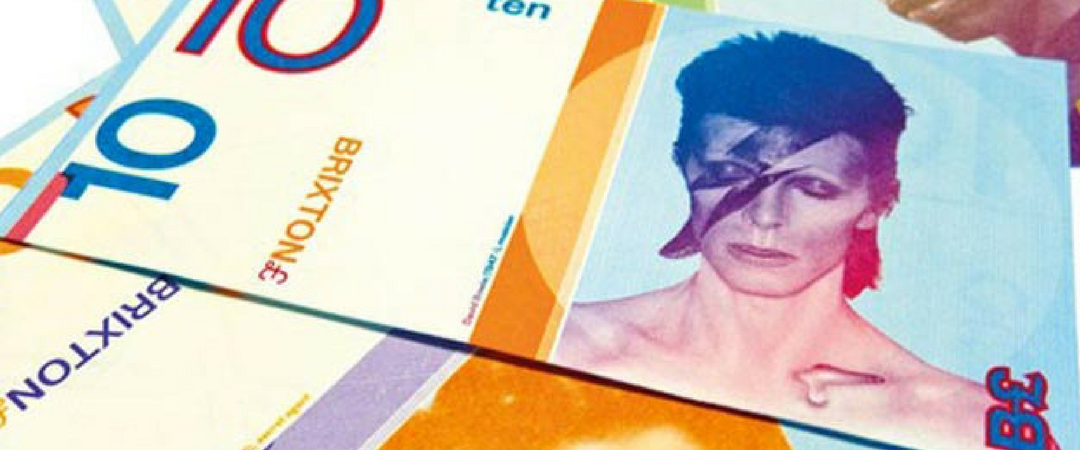

David Bowie: Get creative

David Bowie, one of the most influential musicians of his era died in January with an estimated net worth of £350m-£600m and, like Michael Jackson, Elvis Presley and John Lennon, his estate will continue to generate huge sums as fans continue to buy his music. But it was nearly not so and the singer was thought to be close to bankruptcy in the 1970s with a string of bad business deals.

But his creativity was not limited to music and he anticipated the challenges of streaming saying ‘Music itself is going to become like running water and copyright will no longer exist in ten years”.

So in 1997, the singer introduced ‘Bowie Bonds’. These allowed people to invest in his future earnings for ten years, before ownership of the songs returned to the singer. This scheme gave Bowie the cash he needed to buy out his former manager who had owned up to 50 per cent of his lucrative back catalogue. He was also a prolific investor in properties.

Lesson: The most important thing in money, as in life, is to recognise the reality of your situation and get creative with solutions. Bowie famously said “it doesn’t matter if you think it’s exciting or not; it’s what’s going to happen”

Prince: Have a will

We lost the Purple One in April. Known for his amazing voice and incredible talent he leaves behind a musical legacy that will not die despite his passing.

Prince was diligent about protecting his intellectual property during his lifetime. He pulled his music from streaming and online platform and his estate is valued at between $150m-$300m.

So it’s curious that there is an absence of clear legal directive. With (seemingly) no will and no indication about what should be done with his sizeable fortune his estate now goes to probate meaning a Minnesota state court will now have responsibility for figuring out what Prince owned and owed and how to divvy it all up.

Lesson: The second you have assets make sure you have a will.

George Michael: diversify

George Michael died with an estimated net worth of $175m-$200m, a fortune accumulated over a lifetime as a singer and also record producer and songwriter. During his lifetime, George sold over 100 million albums worldwide but also appeared at intimate gigs, Sir Philip Green’s 55th birthday party and Russian tycoon Vladimir Potanin NYE party, where he commanded vast sums (£1.5m and £1.78m respectively).

The soundtrack to many GenXrs life Michael was a generous man and numerous stories have been surfacing since he passed away including tipping a barmaid £5k after he overheard he crying about her student debt.

Michael’s existing estate includes a portfolio of multimillion-dollar real estate holdings in England, Los Angeles, and Sydney. He also owned cars and boats and had and he invested heavily in art, especially on contemporary pieces by famous British artists.

Lesson: spreading your assets around (and earning money from a variety of sources) is known as diversification. It’s a terrific way of managing your risk and maximising the likelihood of being financially secure regardless of circumstances.

Alan Rickman: Be generous

The ultimate and most delicious bad guy. I actually cried when I heard of Alan Rickmans passing in mid January.

He is the 20th highest grossing actor in movie history mostly thanks to Harry Potter. And since his passing countless stories have come out about how “Harry Potter” became his excuse for paying for people’s meals and treating them.

But his generosity extended to charities too and he lent his talent, his time and his name to countless charities and charitable organisations throughout his life. His will indicates that funds were bequeathed to a number of charities including The Royal Academy of Dramatic Art, Sponsored Arts for Education, Saving Faces and the International Performers Aid Trust.

Lesson: There are over 166,000 registered charities in the UK many of which couldn’t survive without the publics’ incredible level of financial support. If you don’t have money give your time or talent – not just because it helps others but because altruism makes us feel good about ourselves too.

Mohammed Ali: Mind your money

Mohammed Ali is rightfully called a legend. A giant of a man with immense talent his death brought to a close an extraordinary life. But despite being a hero in the ring Ali avoided confrontation when it came to his money and when he died, in June, the extent to which he was ripped off by those he trusted, came to light.

Estimates for Ali’s total career earnings range from $40m-$82m but his investments were mostly disastrous, driven by emotions, not business acumen.

He may have been “the greatest” but his emotional attitude towards money meant Mohammed was more concerned about looking the part of the prosperous businessman than he was about managing his money or minding his finances.

He put his name to restaurants, a soda company and movie deals which all ended in bankruptcy and was taken for a ride by advisors and trusted friends. $2.5m, set aside to pay his taxes, was siphoned by an unscrupulous advisor and $21m was plundered from a sports company set up in his name to recruit aspiring athletes from poor areas. At the time of his death Ali was spending almost $65k each month on the car payments, mortgages and insurance of family and friends on top of his own bills.

Lesson: The best thing you can do for your money is keep an eye on it and invest in your knowledge and skills. Experts and advisors are key as your wealth grows but never lose track of where your money is and who has access to it.

Carrie Fischer: Insurance

Oh Princess Leia – how sad we were to see you become at one with the force a few weeks ago and a double tragedy when your mum, Debbie Reynolds died of a broken heart the next day.

Fascinatingly, since her passing, it has come to light that Walt Disney Studios took out “contract protection cover” as insurance in case she couldn’t fulfil her obligations to appear in the new Star Wars movies.

Insurance is a game of odds with both sides hoping it will never be paid out (since that usually means something bad has happened) but it is a way of protecting the downside of a bad thing happening.

Carrie Fisher can’t participate in Star Wars: Episode IX, due for release in 2019, but if the insurance rumours are true Disney may be able to claim a $50m payout.

Many celebrities and sports stars have (apparently got) insurance too including Cristiano Ronaldo ($100m against serious injury), Dolly Parton (£3.8m for her breasts), Daniel Craig ($9.5m for his body) and Jennifer Lopez ($27m for her bum).

Lesson: bad things can happen (unexpectedly!) and if they are likely to cause you material harm or expense then insurance is money well spent. A friend had a heart-attack, aged 22, while travelling in the US – it cost over $250k for treatment while there… could you afford that? Do your maths and speak to a professional advisor but get covered.